Voxco Intelligence for Banking & Financial Services

An end-to-end data & analytics platform for financial service providers

- Leverage insights to make data-driven decisions,

- Improve customer experience

- Detect fraud

- Predict risk

- Automate underwriting

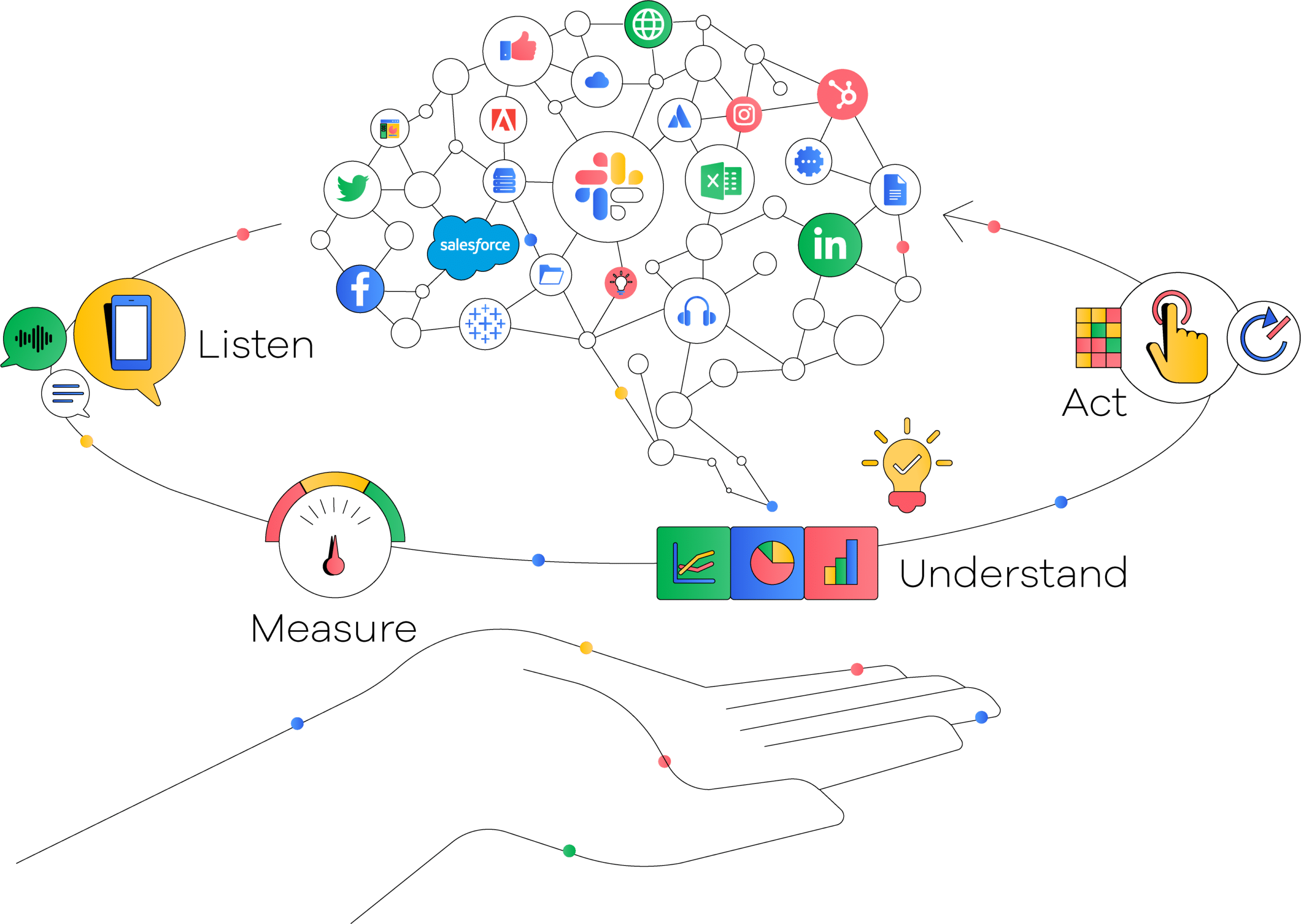

The finance industry has massive amounts of transactional and non-transactional data scattered across channels that continue to grow in size and complexity. Voxco Intelligence, with its AI & ML capabilities, helps financial service providers integrate customers’ data from multiple data sources including their interactions, credit history, purchase activities, transactions across the web and mobile apps to reveal predictive insights. |

Reduce turn-around-time for loan/card processing

Reduce loss rates

Identify new customer segments (universe expansion)

Increase approval rate

Voxco Intelligence enables an automated underwriting process and builds loss prediction models that help the Head of Risk CDO tackle major challenges that include:

1.

Slow scale-up caused by manual underwriting

2.

Inability to tap into newer segments like bureau no-hit, underbanked customers, sub-prime customers

3.

Maintenance of relatively high approval rates without sacrificing credit quality

Customer engagement strategies to boost loyalty

Put your customers' data to work like never before

Enrich customer journeys with personalized experiences

Equip all your employees with a 360-degree view of your customers. Enable them to uncover actionable customer insights from every relevant data source and continuously personalize customers’ offline and online experiences including in-branch banking, online banking, in-app experiences, etc.

Spot anomalies and predict risk

Enable analysts to spot small errors and miscalculations across your business with Voxco Intelligence’s risk prediction models. Identify and correct fee, interchange, and interest anomalies to maximize revenue efficiency and boost financial performance.

Foster customer loyalty

Arm sales reps with instant access to the status of customer loans, product type, and overall portfolio mix across channels on a daily basis to help them discover upsell and cross-sell opportunities. The more they know the customer, the better they can anticipate what they’ll respond to.

Quickly spot suspicious activities

Use data and AI-driven insights to better understand and act upon risks you typically face, such as unusual account activity, credit risk, information security, and market and liquidity demands. Combine omnichannel feedback with AI-powered text analytics and risk modeling to reduce risk and losses.

Mitigate losses with instant insights

Empower bank personnel to quickly identify and prioritize every single at-risk borrower. Then take mitigating actions to reduce expected credit losses, thus increasing profitability and liquidity.

Identify customer issues in real-time

Equip customer support staff with insights to take corrective actions and solve problems before they escalate. Enable them to engage with empathy, understand, and handle customer issues in real-time.

Nurture client relationships

Arm relationship managers with comprehensive profiles of customers such as transactions, deposits, and loan data across each client to identify key customer insights and provide a personalized customer experience.

Boost advisor satisfaction

Leverage real-time data, and actionable insights that enable authentic client conversations and provide timely, relevant, and tailored recommendations around life events, from planning for retirement to strategizing intergenerational wealth transfer.

Case Studies

More about Voxco Inteligence

Integrated Data Platform

Break data silos and create a unified view of the customer with AI-infused analytics.

Single Source of Truth

Meet regulatory requirements, while sharing access to a single source of data.

Predictive Analytics

Leverage predictive insights to detect fraud, reduce risk, and foster customer loyalty.