Fraud & Risk management with AI-infused Platform

Generate insights with AI-enabled solutions to mitigate financial risk and drive profitability across the organization. In real-time and at scale.

Facilitate timely identification of threats and risks to implement an organization-wide effective framework with a fraud risk management platform.

Assess risk & reinforce financial management

Leverage big data and analytics to identify fraud threats or risk across financial domains and customer segments.

An end-to-end data analytics platform to prevent financial crimes & enable faster insights.

Build an effective fraud risk management framework to identify organization-specific risks at an early stage.

- Unified view of data.

- Automate fraud detection.

- Estimate risk for existing customers.

- Accurate fraud prediction.

- Optimize risk/return trade-off

- Tailored recommendations in response to fraud risk.

Leverage Risk Management and Fraud Analytics to Transform Financial Services at scale

Leverage integrated risk management and fraud analytics to generate intelligent insights while keeping data safe and financial threats at bay.

Process risk with a holistic & cost-effective approach. Improve efficiency and proactively manage financial performance.

Minimize risk:

Identify and minimize risk in real-time. Leverage AI & ML to address financial threats, frauds, and crimes before going out of hand.

Improve productivity:

Arm your fraud & risk management team with AI, automation, big data, and advanced analytics to fight off fraud & financial crimes.

Machine Learning model:

Build predictive models to perform financial analysis. Cut down false positives and focus on high-priority risk cases.

Instant fraud prediction:

Combine claims and corporate data to identify fraud and associate scores in real-time.

Improve financial performance:

Integrate raw customer data & leverage advanced analytics to improve fraud detection accuracy and decision-making.

Boost efficiency:

Equip your teams with actionable intelligence and analytics to assess financial risk & fraud threats in a holistic context.

Improve risk governance & increase efficiency

Re-invent CX and improve core financial services: Leverage ML capabilities to adapt and refine financial fraud risk management.

Risk management and fraud analytics help automate the analysis of large volumes of data in real-time and creates unique customer profiles to be used for risk assessment.

Customer 360:

Centralize large data volumes once and create a shared data source for everyone.

Predictive analytics:

Use predictive analytics to flag anomalies instantly and automatically. Optimize risk management strategies to streamline financial analysis.

Fraud & risk forecast:

Leverage Machine Learning and alternate data to identify fraud risk. Implement a predictive model to identify triggers that affect fraud.

Acquisition strategies:

Build acquisition models for decisions on targeting, approve/reject, credit line, price, and improve their revenue, activation, and usage. Identify higher-capacity customer segments to build portfolios & target low-risk customers with higher growth potential.

Risk estimation for existing customers:

Using traditional and advanced predictive analytics, lenders can effectively assess the risk of existing customers and personalize offers, products, and services relevant to each customer.

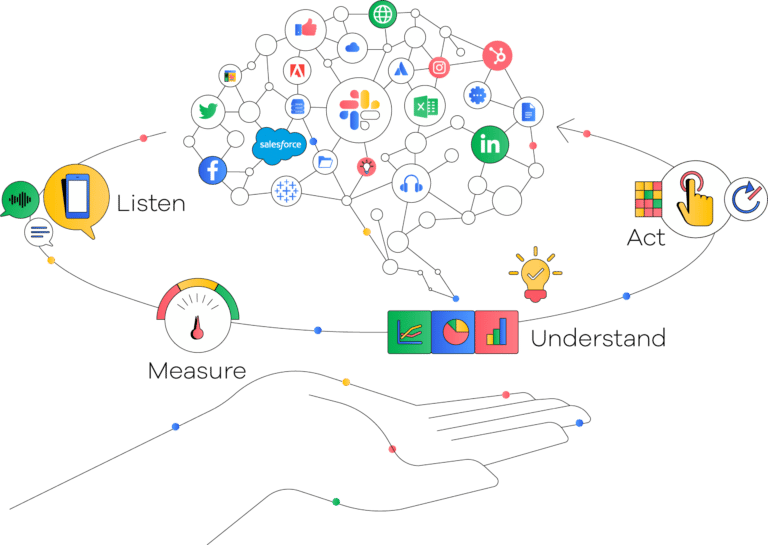

Why Voxco Intelligence?

Voxco Intelligence’s risk management and fraud analytics tools are built to scale and grow business.

Allow decision-makers to analyze and measure financial risks that would otherwise go undetected. Understand the impact of financial risk& Strengthen every service and functionality of your financial services to create a company that customer trusts.

Single source of truth:

Integrate raw data collected from various sources in a single repository. Dissolve data silos and boost productivity & efficiency.

AI & ML capabilities:

Use advanced analytics to analyze data faster with more accuracy. Identify and prioritize high-risk issues.

50+ Integration:

Integrate any source of data, CRM, or internal toolkit to leverage data and information from multiple sources you trust.

Scalable:

Unlock speed of generating actionable insights with real-time triggers and alerts to spot anomalies and boost performance.

Secure data:

Ensure that your customer’s personal data remains protected and your company stays compliant to government regulations.

Best-in-class support:

Our professional and trained experts are available 24 X 7 to help you onboard and walk you through the entire platform to enable you to use every functionality to its full potential.

FAQs

A fraud risk management platform is an integrated risk management process that uses AI & ML models to detect fraudulent activity which otherwise may go unnoticed.

These platforms are trained to share insights while avoiding breaching into sensitive data, thus protecting data privacy but also detecting suspicious activity.

In the era of digital banking, financial firms must be in a position to evaluate & identify risk profiles, especially around fraud, KYC, anti-money laundering, & counter fraud.

With a fraud risk management platform, you can automatically predict suspicious customer profiles, financial risks, false positives, etc. Build operational resilience and evolve as a more reliable organization.

- Identify and minimize risk in real-time.

- Cut down false positives and focus on high-priority risk cases.

- Combine claims and corporate data to identify fraud and associate scores in real-time.

With an organization-wide AI-infused fraud risk management framework financial institutions can leverage the following use cases:

Real-time fraud identification: With AI, ML, and advanced analytics financial firms can analyze transactional data to identify potential fraudulent activity under any profile.

Integrated data & analytics: By centralizing customer data, financial firms can conduct analysis of a large volume of data in real-time and extract hidden insights on unique customer profiles.

Better decision making: With a role-based, real-time dashboard financial institutes can make faster decisions and prevent any loss with timely intervention.