AI-powered Credit Underwriting Solution

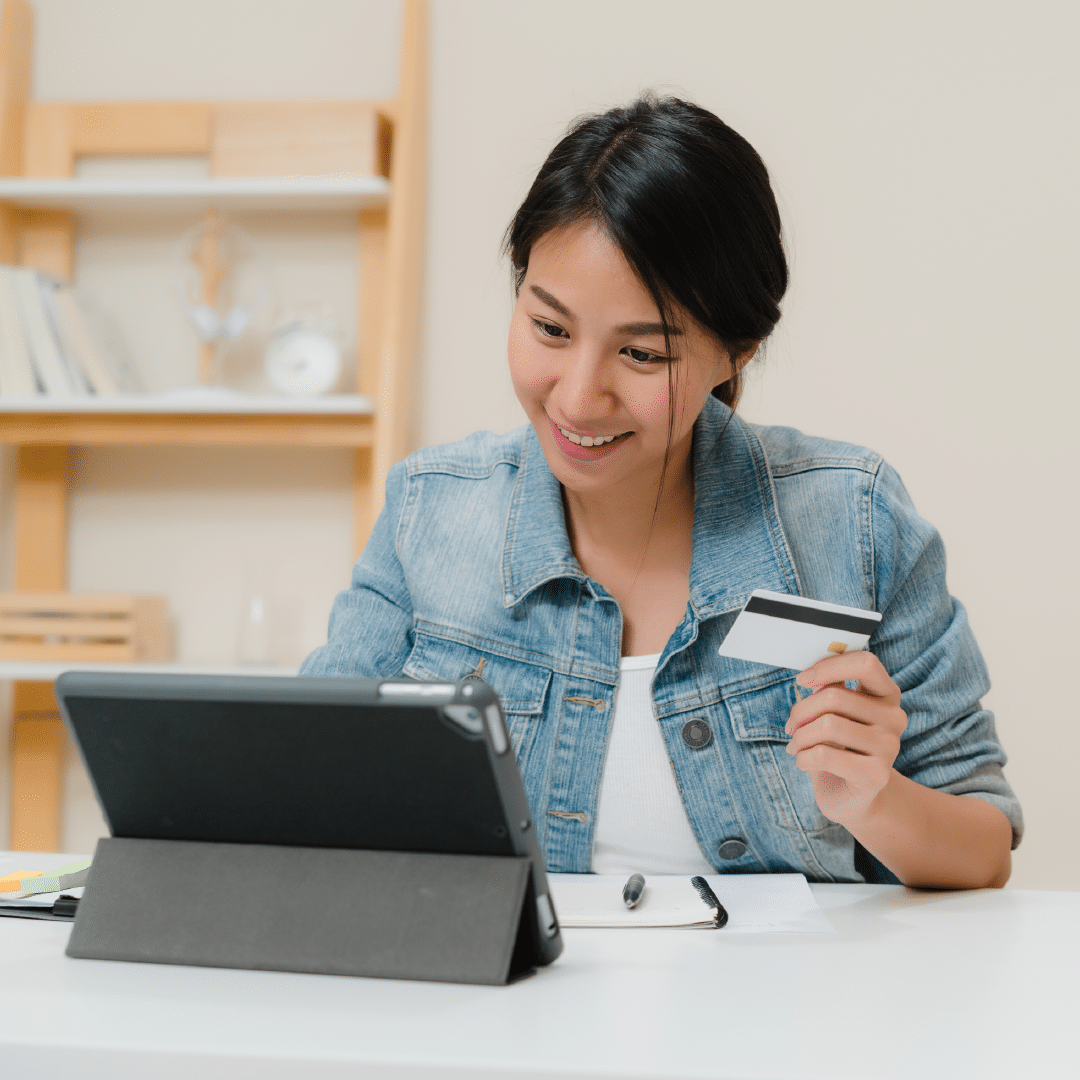

Put credit underwriting on automation with an end-to-end intelligent platform. Improve customer experience – Boost approval rates – Make confident credit decision

Reimagine credit underwriting at scale

Embrace AI, automation, and ML capabilities across credit management processes to enhance business performance.

✅ Detect frauds: Leverage predictive analytics to trace risk in disbursing loans to a client. Automatically alert employees whenever any discrepancy is detected.

✅Consistent underwriting: Stay compliant with the bank’s policies while automating the entire credit underwriting process.

✅Eliminate human error: With an automated credit underwriting solution never miss out on details or risk personal bias.

✅Better CX: Automating the process also reduces the paperwork for customers. The credit underwriting solution facilitates customers’ data to the lender’s platform. The lender can approve the applications which are ready or ask for required documentation without delay.

We help overcome your pain points:

10%

increase in approval rate.

90%

automation in credit underwriting.

15 - 20%

improvement in turn-around-time.

Expedite credit decision & Stop fraud

Unlock the true potential of an AI-driven credit underwriting solution & improve your business performance with the lowest risk and highest return.

Smart automation:

With the AI and ML models, our platform delivers a robust and automated solution for faster resolution of risks and credit decision processes.

Acquisition score and strategy:

Conduct a credit risk assessment of new customers and fraud assessment for identity resolution and verification. Implement acquisition risk strategy and develop scorecards.

Credit Scorecards:

The AI-driven underwriting model uses bureau data and historical data to develop credit scorecards.

Behavior score:

Conduct an ongoing risk assessment of existing customers for account monitoring, credit line increase, top-up, cross-sell and upsell.

AI-driven underwriting:

Develop AI-powered underwriting models to automate credit management- process, evaluate, and approval – of the right application faster and smarter.

Fraud detection & prevention:

Detect fraud risk, prevent approval of fraudulent applications, and cut down the cost of false positives. Leverage AI and ML capabilities to identify high-risk cases that could be missed otherwise.

Identify new customer segments:

Tap into newer customer segments like bureau no-hit, underbanked customers, sub-prime customers.

Collection models:

Build collection models to target customers who may go delinquent in the future and develop strategies to reduce loss.

Empowering financial firms to make smarter credit decisions

Voxco Intelligence’s credit underwriting is an end-to-end data analytics platform that meets the financing needs of all its clients and protects your firm from high-risk fraud attempts.

Financial Services:

Empower your financial management team with an agile underwriting solution to refine your underwriting models to effectively and efficiently address applicants’ evaluation and approval.

Banking:

Arm your managers and frontline employees with an AI-driven underwriting platform that you can modify to process borrowers faster and approve eligible applicants.

Why Voxco Intelligence?

Voxco Intelligence offers an AI-infused credit underwriting solution to accelerate confident decision-making & empowers you to implement an efficient underwriting operation

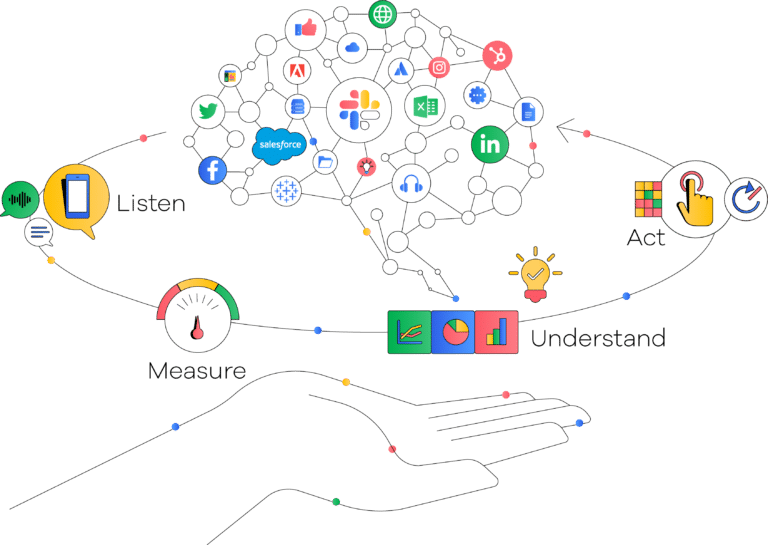

Unified customer data:

Centralize raw data collected from various sources in a single repository. Integrated view of the customer – internal and bureau

AI & ML capabilities:

Use advanced analytics to analyze data faster with more accuracy. Identify and prioritize high-risk issues.

Customizable dashboard:

Build a shared dashboard to boost collaboration among teams.

Or, create a role-based dashboard and give access on a need-to-know basis.

50+ Integration:

Streamline the operational process with frictionless integration with any data source, CRM, or internal toolkit.

Flexible hosting:

Improve business performance and save cost by deciding the best hosting option for your firm – An on-premise or SaaS hosting solution.

Secure data & compliance:

Ensure that your customer’s sensitive financial data remains protected and your company stays compliant with government regulations.

Best-in-class support:

Our trained team is available 24 X 7 to help you onboard and walk you through the entire platform to enable you to use every functionality to its full potential.

FAQs

A credit underwriting solution is an end-to-end data analytics platform that gauges a client’s risk profile. It automates the risk assessment process to determine the borrower’s credibility.

Credit underwriting solutions include using customer data points that go beyond simple bank statements & spending behavior, to assess the quality of the loan applicant.

The credit underwriting solution automates the following process to create a smarter, faster, and more efficient underwriting process.

- Loan application – AI-enabled pre-approval.

- Documentation – Unifying data.

- Credit scores – AI-driven credit assessment.

- Credit decisioning – Analyzing real-time data.

- Loan disbursal – paper-free loan disbursement.