Toyota Financial Services reduces churn and automates credit underwriting.

“Right knowledge at the right hand.”

Alex

Head of Projects, Toyota Finance

About Toyota Financial Services

Toyota Financial Services (IFL) is a wholly-owned subsidiary of Toyota Motor Corporation (TMC) Japan which delivers financial products, services, or experiences through innovation, business transformation, and new technology.

The customer segments TFSIN targets are retail customers, customers who use the car for commercial purposes, & small fleet, and large fleet operators.

Voxco Intelligence has been the data science partner for Toyota Financial Services India Ltd. (TFSIN).

Challenge:

Toyota Financial Services faced a sharp spike in churn across different customer segments, particularly in the ‘cab driver’ segment. TFSIN also anticipated creating a new loan origination system that would incorporate the automated decision process.

What TFSIN needed was a strategic partner to facilitate the development and implementation of a risk underwriting model for commercial and personal auto finance. Additionally, they needed a retention model to predict customers who are likely to take up a second loan.

Successful Business Impact

___

Voxco Intelligence worked together with TFSIN to develop the Credit Underwriting Model which resulted in

- 70% automated underwriting

- 1.5% – 3% of the projected reduction in churn rates (60+ Days Past Due)

Voxco Intelligence also built a Customer Retention model that allowed TFSIN to identify customers who are likely to take up a second loan while reducing the effort and cost of targeting.

- Predictive-driven retention model allowed them to fine-tune dealer commission on a second loan.

Solution Delivered by Voxco Intelligence:

___

Developing Credit-underwriting Model with logistic regression method

Initial Consultation & Scoping:

Voxco Intelligence conducted a consulting exercise to understand the change management processes and the data. Voxco Intelligence developed a robust set of application scorecards:

Commercial and small fleet customers

- Having credit bureau information

- Not having credit bureau information

Retail customers

- Having credit bureau information

- Not having credit bureau information

Developing Model:

Voxco Intelligence used its unstructured data processing utilities to leverage the historical data to create credit characteristics from the bureau data. Multiple methodologies, including statistical learning ( Logistic Regression) and ML (Gradient Boosting), were tested to identify the best-suited model.

Ultimately, Logistic Regression was selected for the model. While Gradient Boosting provided the highest predictive power, the same was not significantly different from logistic regression.

Logistic regression: It is a type of statistical analysis used to understand the relationship between the dependent variable and one or more independent variables by estimating probabilities using a logistic regression equation

Gradient Boosting: Gradient boosting is one of the Machine Learning algorithms used to minimize bias error of the model. It relies on the intuition that the best possible next model minimizes the overall prediction error when combined with previous models.

Scenario Analysis: Post Model Development

After developing the credit underwriting model, Voxco Intelligence performed a scenario analysis to determine the possible impact of the developed model on straight-through processing, approval rate, churn rate, and current underwriting processes.

The results were discussed in an interactive workshop and the feedback from the workshop was used to create the policy rules and the modified underwriting process.

Building Retention Model with predictive analytics

Voxco Intelligence built an analytical framework for predicting retention of existing customers for TFSIN.

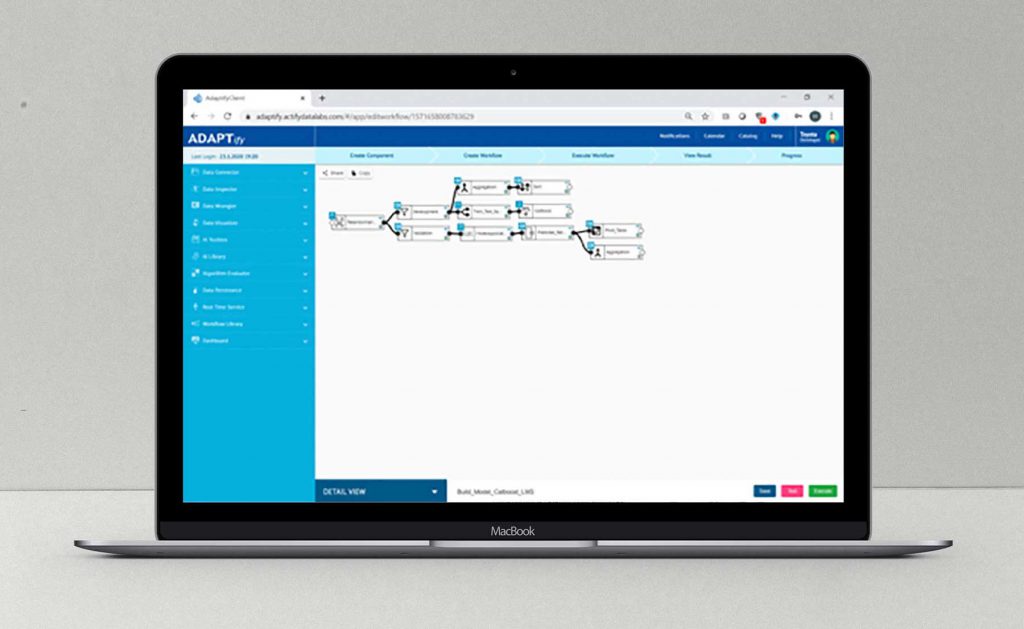

Voxco Intelligence developed a retention data mart in ADAPTify. Then they developed a retention model to identify which customers are likely to take up a second loan.

The retention model helped TFSIN fine-tune dealer commission on the second loan. Additionally, it helped them target the right customers, reducing the effort to cross-sell and the cost of targeting.

Workflow for building retention model

__