Effectively using Research Software for better insights

Effectively using Research Software for better insights Free Download: Enhance NPS® Scores using our NPS® Survey Templates Download Now SHARE THE ARTICLE ON Research is

Find the best survey software for you!

(Along with a checklist to compare platforms)

Take a peek at our powerful survey features to design surveys that scale discoveries.

Explore Voxco

Need to map Voxco’s features & offerings? We can help!

Find the best customer experience platform

Uncover customer pain points, analyze feedback and run successful CX programs with the best CX platform for your team.

We’ve been avid users of the Voxco platform now for over 20 years. It gives us the flexibility to routinely enhance our survey toolkit and provides our clients with a more robust dataset and story to tell their clients.

Steve Male

VP Innovation & Strategic Partnerships, The Logit Group

Explore Regional Offices

Find the best survey software for you!

(Along with a checklist to compare platforms)

Take a peek at our powerful survey features to design surveys that scale discoveries.

Explore Voxco

Need to map Voxco’s features & offerings? We can help!

Find the best customer experience platform

Uncover customer pain points, analyze feedback and run successful CX programs with the best CX platform for your team.

We’ve been avid users of the Voxco platform now for over 20 years. It gives us the flexibility to routinely enhance our survey toolkit and provides our clients with a more robust dataset and story to tell their clients.

Steve Male

VP Innovation & Strategic Partnerships, The Logit Group

Explore Regional Offices

Find the best survey software for you!

(Along with a checklist to compare platforms)

Take a peek at our powerful survey features to design surveys that scale discoveries.

Explore Voxco

Need to map Voxco’s features & offerings? We can help!

Find the best customer experience platform

Uncover customer pain points, analyze feedback and run successful CX programs with the best CX platform for your team.

We’ve been avid users of the Voxco platform now for over 20 years. It gives us the flexibility to routinely enhance our survey toolkit and provides our clients with a more robust dataset and story to tell their clients.

Steve Male

VP Innovation & Strategic Partnerships, The Logit Group

Explore Regional Offices

Effectively using Research Software for better insights Free Download: Enhance NPS® Scores using our NPS® Survey Templates Download Now SHARE THE ARTICLE ON Research is

10 Best Employee Satisfaction Survey Questions and Why You Must Ask Them SHARE THE ARTICLE ON Table of Contents Employees who are pleased with their

Strategy for Market Segmentation SHARE THE ARTICLE ON Share on facebook Share on twitter Share on linkedin Voxco is trusted by 450+ Global Brands in

Data Profiling – How to Perform Data Quality Checks SHARE THE ARTICLE ON Share on facebook Share on twitter Share on linkedin Table of Contents

Decoding Focus Groups: Your Ultimate Guide to Successful Market Research SHARE THE ARTICLE ON Table of Contents In the realm of market research, the focus

Panel Management Market Research SHARE THE ARTICLE ON Share on facebook Share on twitter Share on linkedin Table of Contents What is Panel Management? A

Emicity Research consultant case study SHARE THE ARTICLE ON Research Consultancy Emicity’s Drives Productivity & Stays Competitive With Voxco The Client Emicity is a research consultancy

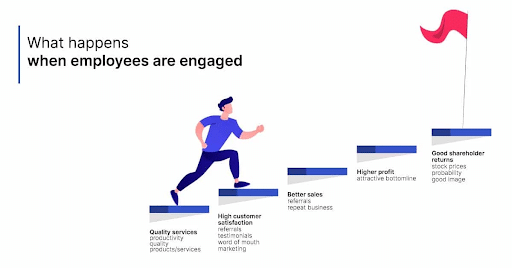

How to create an employee engagement surveys SHARE THE ARTICLE ON Table of Contents An employee must think that the business actually cares about them

Market Intelligence Research: The Key to Business Success See what question types are possible with a sample survey! Try a Sample Survey Table of Contents

Agile Market Research SHARE THE ARTICLE ON Share on facebook Share on twitter Share on linkedin Voxco is trusted by 450+ Global Brands in 40+

Market Research Surveys: Types & Uses Today, market research surveys are bigger than they ever were, being tools that help businesses lead with valuable insights.

Target Market Voxco is trusted by 450+ Global Brands in 40+ countries See what question types are possible with a sample survey! Try a Sample

Ad Effectiveness Study SHARE THE ARTICLE ON Table of Contents Advertisement is an age-old method to attract customers towards a brand, its products, and services.

Quantitative Data Collection: Types, Tools, and Methods SHARE THE ARTICLE ON Table of Contents Data collection and analysis is a proven method to make a

How Tools of Business Intelligence Help in an Organization’s Growth SHARE THE ARTICLE ON Table of Contents Every day a business gathers customer data from

Maximize The Value Of NPS Analysis For Your Business SHARE THE ARTICLE ON Table of Contents NPS Analysis is important as it provides you with

What are Scales of measurement? Try a free Voxco Online sample survey! Unlock your Sample Survey SHARE THE ARTICLE ON Share on facebook Share on

How to Calculate Your Market Size: A Comprehensive Guide Voxco is trusted by 450+ Global Brands in 40+ countries See what question types are possible

Ultimate Guide to Demographic Segmentation Voxco is trusted by 450+ Global Brands in 40+ countries See what question types are possible with a sample survey!

Top 15 Employee Experience Survey Questions for 2024 SHARE THE ARTICLE ON Table of Contents Employee engagement is a journey that impacts the health of

We use cookies in our website to give you the best browsing experience and to tailor advertising. By continuing to use our website, you give us consent to the use of cookies. Read More

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| hubspotutk | www.voxco.com | HubSpot functional cookie. | 1 year | HTTP |

| lhc_dir_locale | amplifyreach.com | --- | 52 years | --- |

| lhc_dirclass | amplifyreach.com | --- | 52 years | --- |

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _fbp | www.voxco.com | Facebook Pixel advertising first-party cookie | 3 months | HTTP |

| __hstc | www.voxco.com | Hubspot marketing platform cookie. | 1 year | HTTP |

| __hssrc | www.voxco.com | Hubspot marketing platform cookie. | 52 years | HTTP |

| __hssc | www.voxco.com | Hubspot marketing platform cookie. | Session | HTTP |

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _gid | www.voxco.com | Google Universal Analytics short-time unique user tracking identifier. | 1 days | HTTP |

| MUID | bing.com | Microsoft User Identifier tracking cookie used by Bing Ads. | 1 year | HTTP |

| MR | bat.bing.com | Microsoft User Identifier tracking cookie used by Bing Ads. | 7 days | HTTP |

| IDE | doubleclick.net | Google advertising cookie used for user tracking and ad targeting purposes. | 2 years | HTTP |

| _vwo_uuid_v2 | www.voxco.com | Generic Visual Website Optimizer (VWO) user tracking cookie. | 1 year | HTTP |

| _vis_opt_s | www.voxco.com | Generic Visual Website Optimizer (VWO) user tracking cookie that detects if the user is new or returning to a particular campaign. | 3 months | HTTP |

| _vis_opt_test_cookie | www.voxco.com | A session (temporary) cookie used by Generic Visual Website Optimizer (VWO) to detect if the cookies are enabled on the browser of the user or not. | 52 years | HTTP |

| _ga | www.voxco.com | Google Universal Analytics long-time unique user tracking identifier. | 2 years | HTTP |

| _uetsid | www.voxco.com | Microsoft Bing Ads Universal Event Tracking (UET) tracking cookie. | 1 days | HTTP |

| vuid | vimeo.com | Vimeo tracking cookie | 2 years | HTTP |

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| __cf_bm | hubspot.com | Generic CloudFlare functional cookie. | Session | HTTP |

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _gcl_au | www.voxco.com | --- | 3 months | --- |

| _gat_gtag_UA_3262734_1 | www.voxco.com | --- | Session | --- |

| _clck | www.voxco.com | --- | 1 year | --- |

| _ga_HNFQQ528PZ | www.voxco.com | --- | 2 years | --- |

| _clsk | www.voxco.com | --- | 1 days | --- |

| visitor_id18452 | pardot.com | --- | 10 years | --- |

| visitor_id18452-hash | pardot.com | --- | 10 years | --- |

| lpv18452 | pi.pardot.com | --- | Session | --- |

| lhc_per | www.voxco.com | --- | 6 months | --- |

| _uetvid | www.voxco.com | --- | 1 year | --- |